BEAR MARKET TO CLOSE THE WEEK

Even though there were more upward than downward closing sessions on the Nigerian stock market for the week ending November 8, it was unable to finish in the green zone.

As the third quarter (Q3) earnings season came to a close, some investors bought value stocks at bargain prices, while others positioned themselves to benefit on interim dividends offered by firms.

High fixed-income returns are luring investors away from stocks and onto the sell side of the Nigerian Bourse, where record pressure is being driven primarily by that space.

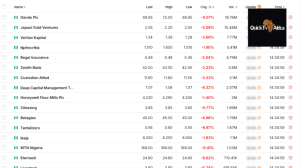

Additionally, compared to the previous trading week, 42 stocks saw a decrease in price, down from 45. On the other hand, 79 equities stayed the same, up from 68.

All-Share Index (ASI) of the Nigerian Exchange Limited (NGX) fell 0.20 percent to 97,236.19 points and equities market capitalisation fell to N58.920 trillion as a result of the review week’s mixed trading sessions.

The NGX ASeM index concluded at a flat level, while the NGX Main Board, NGX 30, NGX Lotus II, and NGX Industrial Goods indices depreciated by 0.48%, 0.17%, 0.08%, and 0.02%, respectively, according to the market’s weekly report. All other indices, however, finished higher.